44 h and r block self employed

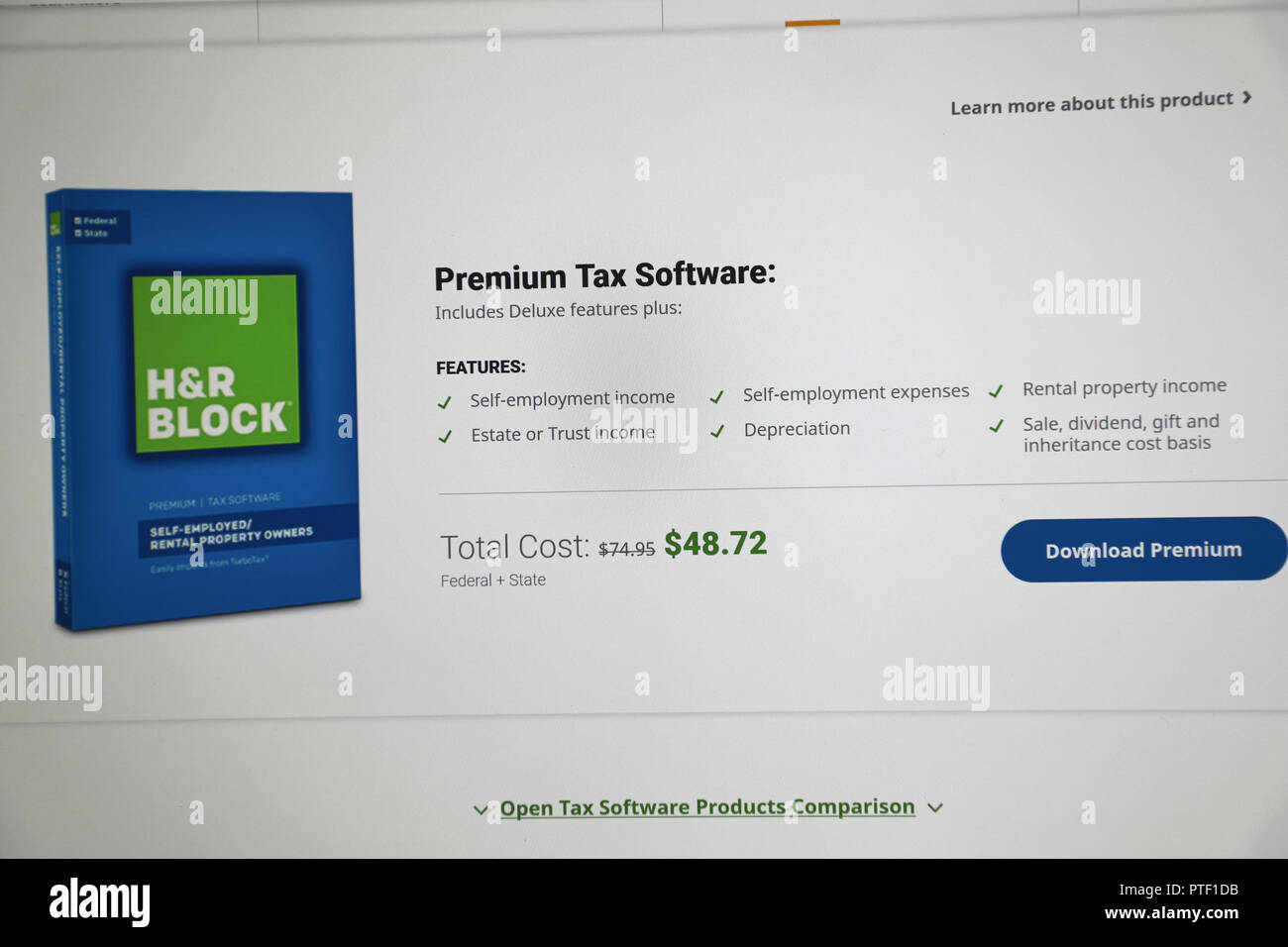

Amazon.com: H&R Block Tax Software Premium 2021 with 3% ... H&R Block Premium Tax Software offers everything people need to easily file complex individual federal and state taxes—including a help center with over 13,000 searchable articles. Refund Bonus Offer: Terms and Conditions • Amazon.com Gift Card offer is for federal refunds only. Amazon.com: H&R Block Tax Software Premium 2020 with 3.5% ... Self-Employed/Rental H&R Block tax software helps you get your Maximum Refund, guaranteed. If your tax situation is a little more complicated, choose Premium tax software for guidance with Schedule C, self-employed, and rental property owners.ers and investors.

Paying Self-Employment Tax | H&R Block Self-employment tax is a tax consisting of Social Security and Medicare taxes primarily for individuals who work for themselves. It is similar to the Social ...

H and r block self employed

Deducting Your Self-Employed Vehicle Expenses | H&R Block H&R Block will explain the position taken by the IRS or other taxing authority and assist you in preparing an audit response. Does not include Audit Representation. H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation. Consult your own attorney for legal advice. PDF Self-Employed Online federal forms - H&R Block H&R Block Online | Federal Forms | Tax Year 2021. ... Form 7202 Credits for Sick and Family Leave for Certain Self-Employed Individuals Form 8283 Noncash Charitable Contributions Form 8332 Release of Claim to Exemption ... Schedule H Household Employment Taxes Schedule K-1 Estate and Trust Income Best tax services for the self employed: TurboTax vs. H&R ... If you're self-employed or run a SMB, you know that your tax requirements require a little extra work. We've pulled together the best tax software options to...

H and r block self employed. Self Employed Tax Filing | H&R Block H&R Block will explain the position taken by the IRS or other taxing authority and assist you in preparing an audit response. Does not include Audit Representation. H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation. Consult your own attorney for legal advice. Tax Dictionary - Self-Employment Tax | H&R Block More from H&R Block. Self-employment tax (SE tax) is made up of Social Security and Medicare taxes. If you earn self-employment income, reported on Form 1099-MISC, you must pay a 15.3% self-employment tax. However, if you're classified as an employee and earn wages reported on Form W-2, your employer pays half of your SE tax (7.65%). Tax Information Center - Self-Employed | H&R Block Self-employed When you're self-employed, it's important to keep up with your tax obligations. Learn more about filing and reporting and get tips for staying organized from the experts at H&R Block. We've been helping tax filers like you since 1955. Recent posts View all posts Featured DoorDash taxes News H&R Block Self Employed Coupon & Promo Code | Top 2022 Offers Get H&r Block Self Employed coupon code "DISCOUNT". Use this code at checkout. Discount automatically applied in cart. Offer ends 2022-03-15. Only valid at H&r Block Self Employed. 10 % OFF. Receive 10% Off Your H&r Block Self Employed Next Purchase. See Details. Use H&r Block Self Employed code: "SAVING10".

H&R Block's new Self-Employed product integrates Stride's ... "In addition to other enhancements to H&R Block's tax season 2018 products, we are excited to introduce a new product to address the ever-growing needs of self-employed taxpayers," said Heather Watts, senior vice president and general manager of digital at H&R Block."We're also partnering with Stride, the leading provider of software and services for self-employed individuals, giving ... Newsroom - Self-Employed | H&R Block H&R Block can help self-employed taxpayers with understanding their unique tax filing obligations and benefits. Recent posts View all posts. View all posts. Featured. 3 things Main Street America can do right now to create business resilience. Popular. Three ways to flip a house, but not flop the taxes Self-Employed Online Tax Filing and E-File Tax Prep - H&R ... Self-Employed tax filing makes your taxes work for you. H&R Block Self-Employed Online tax filing service has all the bells and whistles that self-employed people and small business owners need to complete their taxes easily and correctly. With the max refund, guaranteed. Now, that's good business. Tech specs & supported forms Best tax services for the self employed: TurboTax vs. H&R ... Best tax services for the self employed: TurboTax vs. H&R Block. March 18, 2022.

H&R Block Tax Software Premium 2021 Key Card for Windows and ... item 2 New H&R Block 2021 Tax Software Premium Self-Employed Rental PC Windows Mac 2 - New H&R Block 2021 Tax Software Premium Self-Employed Rental PC Windows Mac $33.00 Free shipping H&R Block Review 2021 - New Features for Tax Year 2020 ... If so, you'll love H&R Block Self-Employed. When you pay for this version, you can directly import your Uber income (1099-K, 1099-MISC) from your driver account. Currently, H&R Block Self-Employed... 2022 H&R Block vs. TurboTax - SmartAsset H&R Block Premium - Federal: $70 - State: $37 - Best for investors and rental property owners - All previous features, plus accurate cost basis - Includes Schedule C-EZ, Schedule D, Schedule E, Schedule K-1: H&R Block Self-Employed - Federal: $110 - State: $37 - Best for small business owners and the self-employed Self-employed tax advice for DIY taxes | H&R Block Newsroom To file an accurate tax return, H&R Block encourages self-employed taxpayers to make sure they have all the necessary tax documents and select a tax preparation method that best fits their needs. "The complexity of taxes is often made even more complicated when the taxpayer is self-employed or has a side job.

How to File Taxes as an Independent Contractors? | H&R Block H&R Block will explain the position taken by the IRS or other taxing authority and assist you in preparing an audit response. Does not include Audit Representation. H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation. Consult your own attorney for legal advice.

![H&R Block Tax Software Premium 2021 with 3% Refund Bonus Offer (Amazon Exclusive) [Physical Code by Mail]](https://m.media-amazon.com/images/I/71q6NKjrwqL._AC_SL1500_.jpg)

H&R Block Tax Software Premium 2021 with 3% Refund Bonus Offer (Amazon Exclusive) [Physical Code by Mail]

25% off H&R Block Self-Employed Online - Offers.com H&R Block Self-Employed Overview. The new version of H&R Block Self-Employed is ...

File with tax software. Premium - H&R Block Premium tax software built for complex taxes. H&R Block's premium tax preparation software has the right tools if you're self-employed, a freelancer, an ...

![HR Block Premium 2020 Tax Software For self-employed or rental property owners | 5 Fed E-File + State| [PC/MAC D0WNL0AD+CODE ONLY: Not CD]](https://m.media-amazon.com/images/I/81IEbFJPoAL._AC_SX679_.jpg)

HR Block Premium 2020 Tax Software For self-employed or rental property owners | 5 Fed E-File + State| [PC/MAC D0WNL0AD+CODE ONLY: Not CD]

Is H&R Block Worth it? Reviews and Ratings for H&R Block ... Self-employed online is the more complicated and expensive option which handles all self-employed individuals but it starts at $170 just for federal and an extra $45 for State filing. Ratings The Better Business Bureau has given the company an A+ rating because it is an accredited company that has been in operation for 64 years successfully.

Tax Software for Easy At-Home Preparation & Filing - H&R Block H&R Block offers a range of tax preparation software for everyone from ... For self-employed people; For rental property owners; State program included.

2021 Self-Employed ACA Health Insurance In H&R Block Software Self-employed health insurance premiums are tax-deductible. When your income is low enough, you can also receive a subsidy in the form of a premium tax credit. The tax deduction and the subsidy form a circular relationship. The math is difficult to do by hand but tax software easily handles it for most people. Use H&R Block Downloaded Software

HandR Block Premium Self EmployedRental 2021 Download ... Exp 03/26/22. Handle the demands of tax season with this downloadable H&R Block 2021 Premium tax software for self-employed filers. The step-by-step guide lets you complete your federal and state taxes easily, while compatibility with Windows 10 allows a simple setup. Premium searches offer hundreds of deductions for quick application.

7 H&R Block Coupons, Key Codes (Deluxe 30% Off!) • 2022 Exclusive! H&R Block Online: Deluxe, Premium, Self-Employed + optional help from a live tax pro. Apply coupon and view discount pricing at hrblock.com: Show Less. Use Coupon. Ends March 21, 2022. Download: $10 Off. 2. H&R Block software download.

Best Buy: H&R Block Tax Software Premium: Self-Employed ... H&R Block Premium Tax Software is designed for do-it-yourself customers who want to be in control of their tax preparation experience and feel empowered by completing their own return. Step-by-step Q&A and guidance on more than 350 credits and deductions. Quickly import your W-2, 1099 and last year's personal tax return.

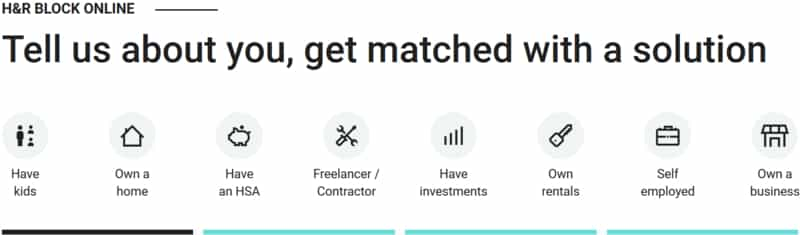

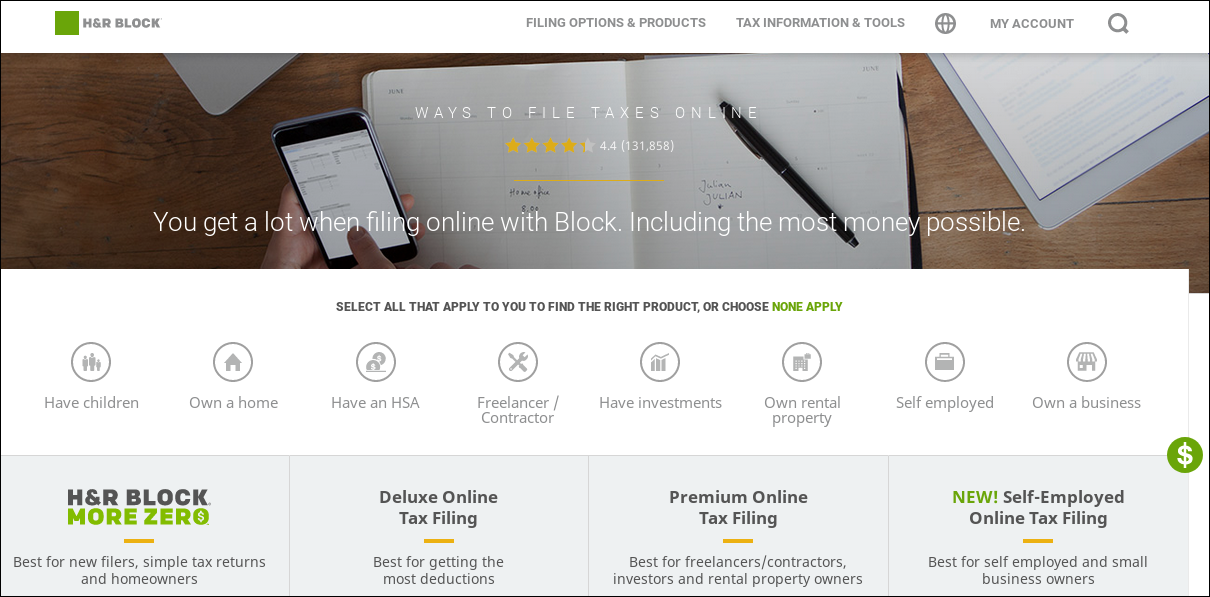

How File Self Employment Taxes On H&R Block | Library of ... H&R Block offers four plans, including a free plan for those with uncomplicated returns, as well as H&R Block Deluxe and H&R Block Premium plans. However, business owners will want to use their Self-Employed Online plan, which offers complete business income and deduction tools as well as a tax entry process designed for ride-share drivers.

H&R Block 1536600-17 Premium 2017 Federal + State Tax Software for Self-Employed/Rental Property Owners

25% off H&R Block Coupons & Coupon Codes 2022 H&R Block Self-Employed : $109.99: $82.49 : See More Details. 25% off H&R Block Deluxe Online Now: $37.49 . Verified on 3/11/22 Used 497 Times Today. Get Deal . 25% off H&R Block Premium Online Now: $52.49 . Verified on 3/11/22 Used 141 Times Today. Get Deal . File Simple Tax Returns for Free with H&R Block Free Online .

H&R Block Self-Employed: Features, Reviews, Cost, Coupon! H&R Block Self-Employed: Features, Reviews, Cost, Coupon! Our review of H&R Block Self-Employed software: H&R Block has a version of it's tax software specifically for the needs of small business owners, Uber drivers, and the self-employed. Their new and improved Self-Employed Online edition includes enhanced tools to maximize potential business deductions, and it's never been easier to file your Schedule C taxes online.

Free Online Tax Filing & E-File Tax Prep | H&R Block® File your taxes for free online with H&R Block. Our free DIY online tax filing ... Organize contract, freelancing, gig work, and other self-employed income ...

File with tax software. Premium & Business - H&R Block Tech specs. H&R Block Premium + Business Tax Software ... With H&R Block, you'll know the price before you start your taxes. ... Self-employed/1099 ...

H&R Block at Home Premium: Good Choice for Self-Employment ... H&R Block at Home Premium tax software has packaging that designates the product as intended for self-employed individuals and rental-property owners. However, unlike Intuit TurboTax Home ...

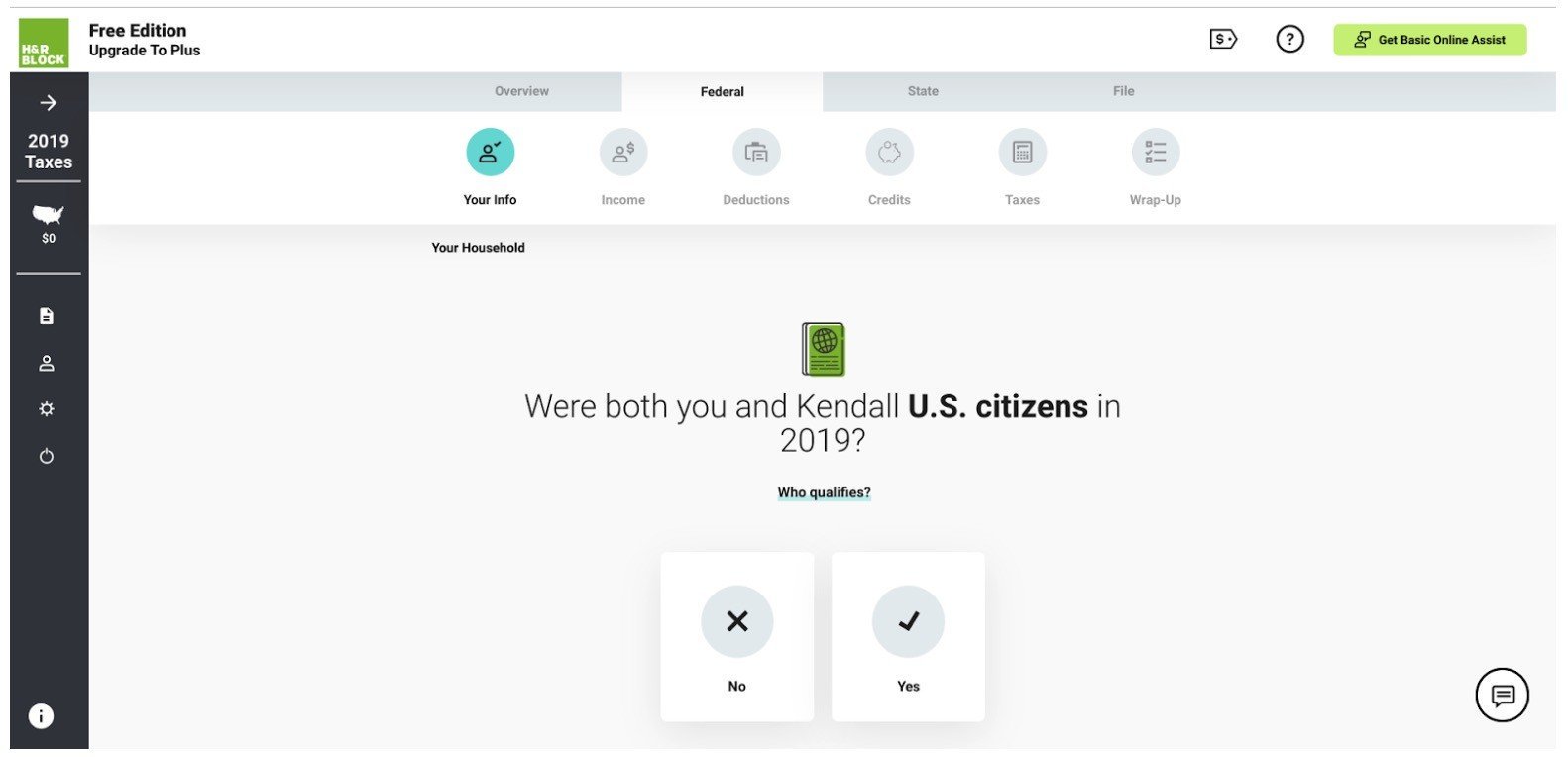

Self-employment income - H&R Block Canada Follow these steps in H&R Block's tax software to file your 2016 taxes: Under the PREPARE tab, click the LET'S TALK ABOUT 2016 icon. Click the checkbox labelled I worked for myself and then select the province or territory you were self-employed in from the drop-down menu. Scroll to the bottom of the page and click Continue.

H&R Block Tax Software Review 2022 | GOBankingRates H&R Block's Self-Employed option is designed for those looking to file as self-employed, as you might expect. But unlike the Deluxe and Premium versions, Self-Employed has features to help small businesses maximize their business expenses and report business deductions and depreciation. The cost is $84.99, plus $36.99 per state return.

Online Tax Filing Services & E-File Tax Prep | H&R Block® This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block. During the course, should H&R Block learn of any student’s employment or intended employment with a competing professional tax preparation company, H&R Block reserves ...

Self-Employed Health Insurance Deductions | H&R Block File with H&R Block Online Deluxe (if you have no expenses) or H&R Block Online Premium (if you have expenses). Have questions about self-employment taxes and other small business tax issues? Rely on our team of small business certified tax pros to get your taxes right and keep your business on track.

TurboTax vs. H&R Block: Which Tax Prep Software Is Best ... Self-employed individuals who need to file Schedule C have to go for the most expensive versions of both. As of this writing, H&R Block Self-Employed is $84.99 for federal returns and $36.99 per...

Best tax services for the self employed: TurboTax vs. H&R ... If you're self-employed or run a SMB, you know that your tax requirements require a little extra work. We've pulled together the best tax software options to...

PDF Self-Employed Online federal forms - H&R Block H&R Block Online | Federal Forms | Tax Year 2021. ... Form 7202 Credits for Sick and Family Leave for Certain Self-Employed Individuals Form 8283 Noncash Charitable Contributions Form 8332 Release of Claim to Exemption ... Schedule H Household Employment Taxes Schedule K-1 Estate and Trust Income

Deducting Your Self-Employed Vehicle Expenses | H&R Block H&R Block will explain the position taken by the IRS or other taxing authority and assist you in preparing an audit response. Does not include Audit Representation. H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation. Consult your own attorney for legal advice.

/hrblock_logo1-c3a5cbb43e1245aabb0e7d9b5df074ae.jpg)

:max_bytes(150000):strip_icc()/HRBlock-2d7df993026a4b5cbe2fa36d6cca506e.jpg)

0 Response to "44 h and r block self employed"

Post a Comment